A 1031 exchange is also known as a tax deferred exchange. It’s simple for an investor to “defer” paying capital gains taxes on an investment property when it’s sold since another “like-kind property” is purchased with profit gained by the sale of the first property.

A 1031 exchange is also known as a tax deferred exchange. It’s simple for an investor to “defer” paying capital gains taxes on an investment property when it’s sold since another “like-kind property” is purchased with profit gained by the sale of the first property.

1031 Exchanges

Thanks to IRC Section 1031, a properly structured 1031 exchange allows an investor to sell a property. It also allows them to reinvest the proceeds in a new property, and defer all capital gain taxes.

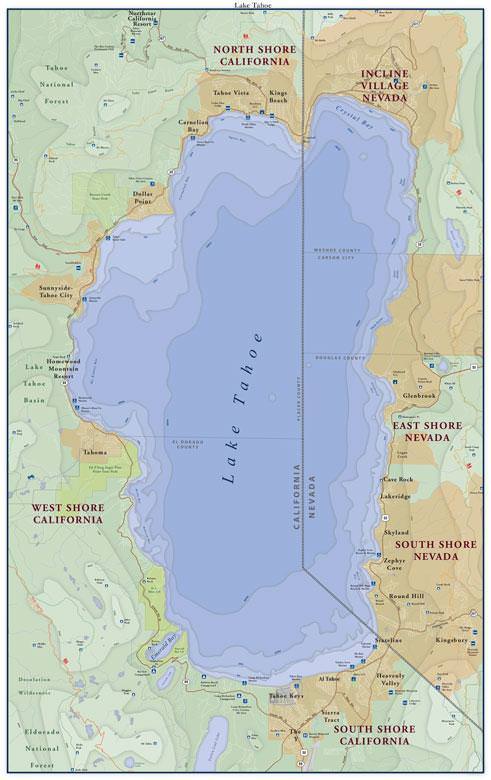

If you sell one property and buy another “like” property, you won’t have to pay capital gains tax on the sale. For example, if you sell a rental income home in San Francisco and buy a house to use as a vacation rental in Lake Tahoe you won’t have to pay capital gains on what you earned on the sale in San Francisco. If you sell a warehouse in Los Angeles and buy a warehouse in Seattle, you won’t have to pay capital gains on the earnings from Los Angeles. The tax deferred exchange only applies to “like” properties that are investment and business properties. You can’t use these properties for primary and secondary residence purchases.

Locally we’ve had several inquiries about “like” properties in which investors are looking for.They want to take advantage of the current market. They’re trying to buy a Lake Tahoe property after they’ve sold their property elsewhere.

Why 1031 exchanges are so popular

Any Real Estate property owner should consider an exchange. They should consider an exchange when they expect to acquire a replacement “like kind” property subsequent to the sale of their existing investment property.

- Anything otherwise would necessitate the payment of a capital gain tax. Current rates for capital gains are between 15% to 20% (depending on what tax bracket you are in).

- Also, include the federal and state tax rates of your given state when doing a 1031 exchange. The main reason for a 1031 is, the IRS depreciates capital real estate investments at 3% per year as long as you hold the investment until it’s fully depreciated.

In order to qualify for an exchange, identify the 2nd property within 45 days of the sale of the first property. Also, the escrow must close within 180 days of the sale of the first property. There are a few other rules, so contact me if you have any questions.

Lake Tahoe 1031 Exchanges Very Popular

In South Lake Tahoe we have opportunities for buyers to find a “like” property to purchase. One can purchase multi-unit properties, commercial properties, and single-family homes depending on what they are selling elsewhere. Just like with Lake Tahoe homes for sale, you can sign up on my website to be notified of when investment properties are listed for sale.

This is just a basic overview of how to do a 1031 exchange. It is important to understand the intricacies of real estate investing, market cycles, and opportunities for financial growth. You can contact Dan directly at (530) 541-2465 if you have questions about doing a 1031 exchange or want to start looking for a new investment property.